As Turkey moves from 2025 to 2026, it faces not only an economic picture but also a set of class preferences. The hunger threshold, the poverty threshold, the cost of living, the burden of taxation... Beyond being economic data, all these indicators reveal what kind of social architecture the country is building, who the political will is working for and who it is not working for.

Today, the reality for millions of laborers, minimum wage earners, pensioners and young unemployed is this:

It's not a struggle for subsistence, it's a struggle for survival.

TÜRK-İŞ's November 2025 data shows this with frightening clarity:

The hunger limit for a family of four is 29,828 TL; the poverty line is 97,159 TL.

In contrast, the minimum wage hovers around 22,104 TL.

This picture shows that the state has long since given up on remembering its social obligations, leaving its citizens at the mercy of the market, debt and inflation. Economic indicators are not a coincidence, but the outcome of a class politics shaped by the conscious choices of the political will.

Indirect Tax Scheme: The Mechanism that Works from the Pockets of the People to Capital

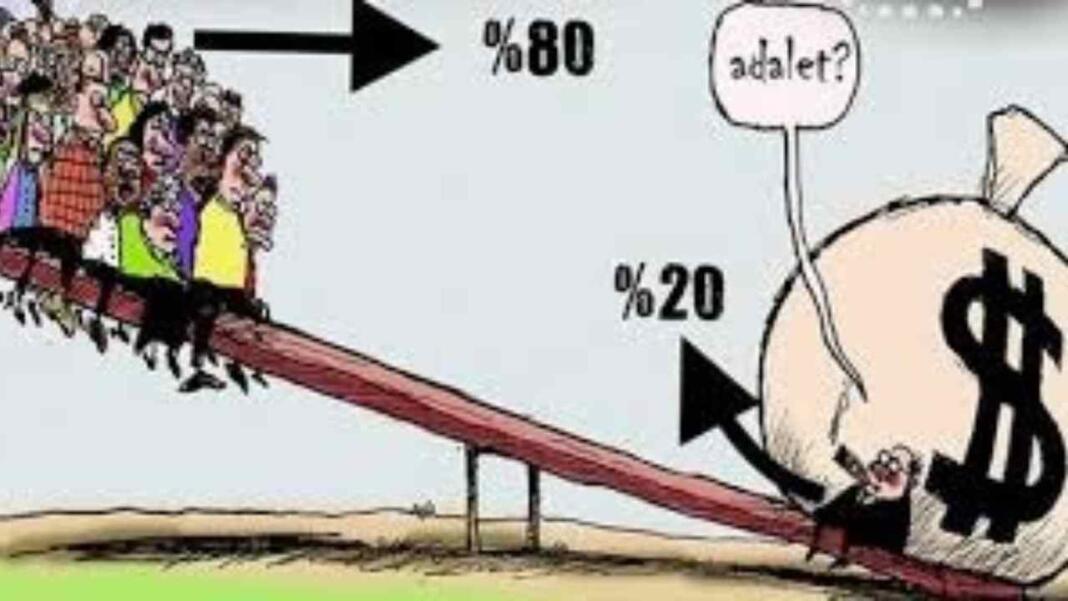

When the 2026 budget is analyzed, the tax architecture reveals not a country's understanding of social justice, but on the contrary how it institutionalizes injustice.

Planned gross tax revenue: TL 15.631 billion

Net tax revenue: TL 13.783 billion

Bu gelirlerin %61,7’si dolaylı vergilerden elde ediliyor.

Dolaysız vergilerin payı ise yalnızca %38.

We are not just talking about a technical distinction here. This distinction shows who pays more taxes in Turkey, who is exempted from tax justice, and who is systematically protected and favored.

Indirect taxes apply to everyone, regardless of income level.

And that means this:

When buying bread, using transportation, opening the bill, the poor pay a much larger proportion of their income in taxes to the state. The rich, on the other hand, do not bear the same burden, but to a lesser extent.

This situation is not only economically distorted, but also morally and socially distorted. This is because the indirect tax system turns every public expenditure into a “tax instrument”, while the contribution of capital, rent owners and finance capital is kept to a minimum.

2026 Budget: A Draft for Debt and Interest, Not for the People

Total revenue is 16.2 trillion TL.

Total expenditure is 18.9 trillion TL.

The budget deficit is 2.7 trillion TL.

And where is the public in the expenses?

Response: Almost nowhere.

The most dramatic item is interest expenditures: TL 2,741.7 billion.

Such a high share of interest payments in a country's budget is not just an economic vulnerability; it is a political choice. This choice goes far beyond technical terms such as “primary deficit” or “budget deficit”:

The state works for debt holders, banks and big capital, not for the laborer.

This is what happened in the 2026 budget.

Personnel expenditures and social security expenditures may seem high in nominal terms, but they erode in the face of inflation. The majority of current transfers consist of items that do not produce social benefits and are merely budgetary make-up. Capital expenditures, on the other hand, are far from reaching the scale that would lift the production economy.

This distribution shows that the budget is not a welfare state document, but a “debt payment protocol” crushed under interest obligations.

What Does Tax History Tell Us?

Turkey's tax composition, with its transformation over the years, actually summarizes everything:

1980: Dolaylı vergiler %37 — Dolaysız vergiler %63

2025: Dolaylı %65 — Dolaysız %33

2026: Dolaylı %61,7 — Dolaysız %38

This is the historical line of the institutionalization of injustice, not tax justice, in Turkey.

Taxation on consumption, the sharpest indicator of the neoliberal era, has fallen on the shoulders of the people in 40 years, while the tax burden on capital has historically declined.

This is not an economic choice; it is a class choice.

And this choice protects only a small group of people, not the whole of society.

Social Consequence: Deepening Social Violence

Today in Turkey, we are no longer just experiencing an economic crisis.

What is happening is an institutionalized form of social-class violence.

The laborer is taxed twice: On consumption and on income.

The poor are penalized for not being able to meet their basic needs.

Capital is rewarded with incentives and exemptions.

Rent revenues are growing almost tax-free.

Finance capital is fed by interest and transfers from the state budget.

Basic needs - food, energy, shelter, transportation - have become relative luxuries.

People's tables are shrinking; capital's bottom line is expanding.

And this is not an accidental deterioration; it is the result of a systematic choice.

The Way Out: A Real Tax and Budget Reform

What Turkey needs today is not a dressing but a structural transformation.

1. VAT/STAT should be zeroed on basic needs.

Taxing the poor on the milk, bread and diapers they buy is against the idea of a social state.

2. Increase taxes on wealth, inheritance and high income.

Justice must be achieved not only in income but also in wealth.

3. Interest payments should be reduced; resources should be directed to production and employment.

TL 2.7 trillion in interest expenditure has become a shackle strangling social investments.

4. Real fight against tax evasion and informality.

It is not justice to inspect shopkeepers collecting receipts when there are billions of liras of illegal income.

5. Strengthen the welfare state and reduce the cost of living for citizens.

Housing, energy, education and health must be eliminated as market products.

6. Budget management should be transparent; expenditures should be planned on the basis of social benefits.

Conclusion Justice Starts with the Budget

The 2026 budget shows us a political orientation rather than an economic choice:

A system that favors capital, not labor.

A system that puts the tax burden on the people.

An approach that sanctifies interest payments and shrinks the social state.

Justice is not only sought in courtrooms.

Justice is most often sought at the table, in the market, in the bill, in education, in housing.

The current budget ignores this justice.

So let's say it clearly:

There is no justice in misery.

There can be no justice in the robbery.

This order is not sustainable.

Turkey will either establish a new economic order based on income and tax justice;

or deepening social collapse will continue to be the fate of millions.

So, this budget debate is not just a technical issue;

democracy, equality and social peace.

And at the threshold we have reached today, the decision is clear:

Either justice - or collapse.